From Microcredits to Financial Health: The evolution of Queen Máxima’s UN work

It all started with microcredit

Everyone deserves the opportunity to develop their skills and build a good life for themselves. Unfortunately, many people don’t ever get that opportunity. Her Majesty Queen Máxima has been fascinated from a young age by the question of how we can change that. Through her studies in economics in Argentina and, later, her work at various banks, she became very familiar with the financial world. And she believes that it is here that we need to start when it comes to offering opportunities. After all, anyone who wants to start their own business, for example, needs money to invest. A small loan can make a big difference. This is true for people around the world.

When the United Nations declared 2005 the International Year of Microcredit, the then Princess Máxima was asked to be part of an international advisory group. Her message was that microcredits give people opportunities and self-confidence. She spoke regularly and enthusiastically about the entrepreneurs she met during her working visits, many of whom were women. A small loan can help people earn more. And that benefits entire families.

The next step: universal participation

Microcredits are important, but helping people get ahead takes more. It’s hard to start a business, for example, without a bank account that provides a safe and easy way to make and receive payments and save money. Even today there are still people who have no choice but to keep their money under their mattresses or face lengthy journeys to pay their bills. And just imagine not having insurance cover for medical costs, accidents or damage. A bit of bad luck can lead to major problems. Everyone deserves to be able to participate in society fully without financial stress. And that’s why it’s imperative that everyone has access to financial services. Not only in the Netherlands and Europe, but also in developing countries, where this is still not the case for hundreds of millions of people.

In 2009, United Nations Secretary-General Ban Ki-moon asked Princess Máxima to help in this regard, appointing her as his Special Advocate for Inclusive Finance for Development. For the past 15 years, she has put her heart and soul into this work.

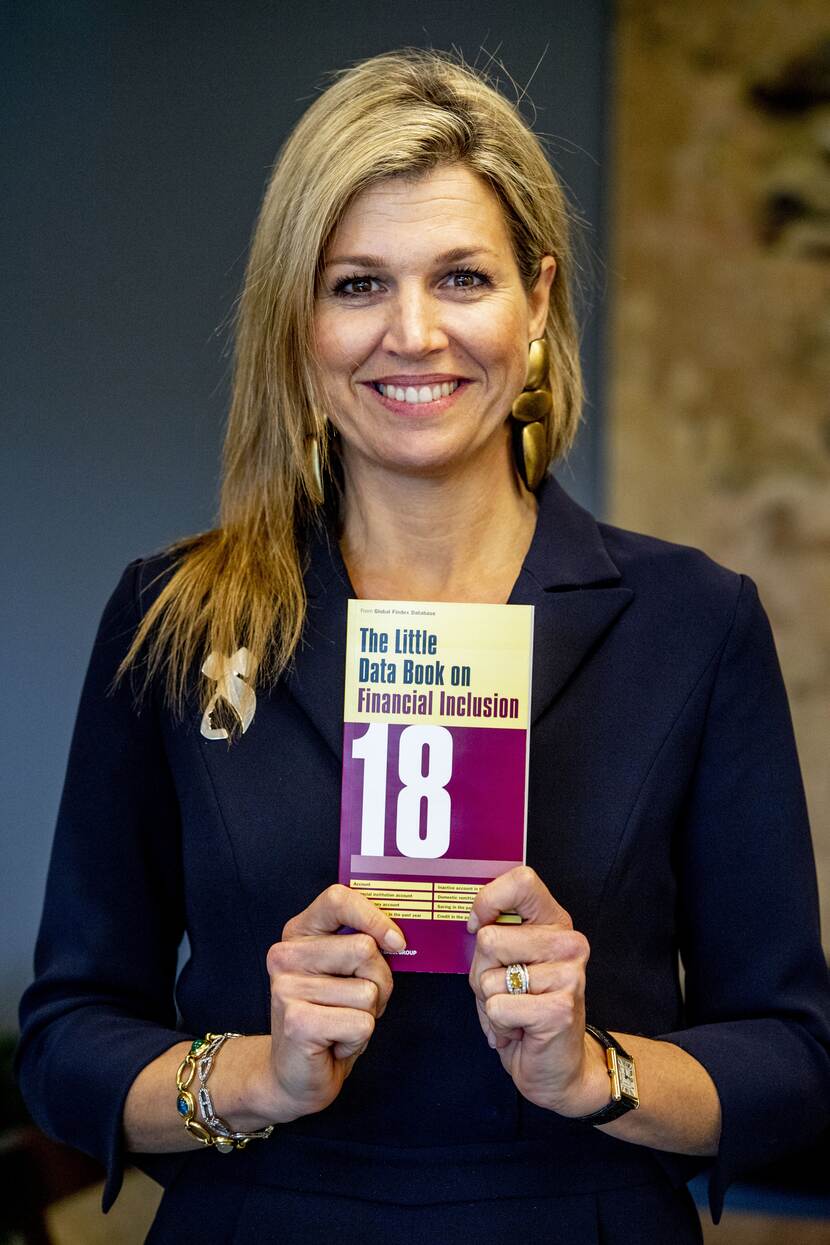

The importance of data

Data is vital to understanding the situation. Queen Máxima has even been known to describe herself as a ‘data freak’. When working towards a goal, measuring progress and knowing how far there is still to go is essential. In 2011, she took the initiative to keep track of how many people in countries around the world have a bank account. Other data, including the number of people who can make digital payments, is also collected. The results are compiled in a little book published by the World Bank, which she always takes with her on business trips and to meetings. A new version is brought out every few years.

Thanks to this book, we now know what great progress has been made. In 2011, 51% of adults around the world had a bank account. Ten years later that had risen to 76%. And this number continues to steadily grow. More and more people are able to participate in society. This is enormously helpful when it comes to meeting the UN Sustainable Development Goals, such as ending poverty and hunger and increasing opportunities for women and girls. The Netherlands is among the countries that score the highest in this area, with 99.7% of all adults having a bank account.

International connections

Meetings aren’t everyone’s favourite activity, but they can’t be avoided when launching a new initiative. Since taking on her UN role, Queen Máxima has sought out cooperation with international organisations that contribute to her mission. She works closely with the G20 (a forum that brings together the world’s major economies) and with the World Bank, which is the largest institution in the world dedicated to fighting poverty. The International Monetary Fund is also an indispensable partner, helping countries with payment problems strengthen their economies and improve their financial health. The Bill & Melinda Gates Foundation also provides vital support for her work.

Queen Máxima encourages countries to make a national plan so that more people can have access to financial services. To date more than 60 countries have been able to do so. This, too, requires extensive consultation with finance ministers, directors of central banks, entrepreneurs and others. Keeping up with all the meetings can make for a busy schedule.

Local communities

Making agreements in meeting rooms is important. But even more important is seeing how those agreements unfold in practice for the people concerned. In her UN role, Queen Máxima often visits the countries she works with. She prefers to start by going into the local community and listening to people’s stories to hear first-hand what works and what doesn’t.

She visits farmers and small business owners, women’s groups, cooperatives, markets, workshops, schools and health centres. She takes the stories of the people she’s talked to with her to the meeting rooms in New York and other major cities. In the first 15 years of her UN work Queen Máxima made 48 visits to 27 countries. From Morocco, Mexico and Brazil to Bangladesh, India and Indonesia – she has visited nearly every corner of the globe.

Sari-sari stores

One of the countries that Queen Máxima has visited numerous times is the Philippines. The country is comprised of more than 7,000 islands, many of which are quite isolated. When she began her work for the UN, only a quarter of Filipino people had a bank account. Today that number has grown to more than half the population.

During her most recent visit to the Philippines, in May 2024, the Queen visited a fishing community on Talim Island. The people there told her how their lives had improved since having access on their island to digital ways of saving, borrowing and taking out insurance. In Manila she spoke to Aubrey Udag who owns one of the thousands of small neighbourhood shops in the Philippines known as sari-sari stores. Aubrey described her store’s success now that she can make payments and borrow money digitally and offer her clients additional services like buying airline tickets. Her dream is to open a shop for her husband too, who works on a cruise ship and is away from home 10 months of the year. Queen Máxima takes the time to listen to people’s experiences and share their stories with others.

Financial health

Access to financial services is essential for everyone. But more than that is needed to build a good life – bank accounts, payment apps and loans are not enough on their own. These services must be safe, reliable and affordable and they must fit people’s individual situations. It would be wonderful if everyone had help to save better and be better protected against unforeseen costs.

Queen Máxima advocates for making financial health a key focus area. This means being able to meet financial obligations without stress, being able to absorb unexpected costs and having the peace of mind and scope to reach future goals. The importance of financial health has steadily gained a more prominent place in her work for the UN over the years. Since September 2024, this has also been reflected in the new title of her UN role: UN Secretary-General Special Advocate for Financial Health.

Money Wise

Queen Máxima doesn’t only work at international level to promote financial health. She does the same in the Netherlands, for instance through her efforts in the areas of financial education and awareness. Since 2010 she has been honorary chair of the Money Wise Platform, through which the government, consumer organisations, knowledge institutions, banks and insurers collaborate on projects aimed at helping people manage their personal finances and prepare for important life events. Some things in life, such as moving in with someone, studying, buying a home and starting a business, are choices you make yourself. Others, such as illness or divorce, are unforeseen. Regardless of what happens, having insight into your personal finances and making responsible choices provides a good foundation and resilience. The importance of financial health is fortunately increasingly recognised in the Netherlands.

It’s important to learn good habits early so that they stay with you as you get older. That’s why there is a special focus on young people, for instance during the annual National Money Week. The Queen regularly participates, discussing difficult issues such as the questionable advice given by ‘finfluencers’ and the temptation of buying things on credit.

Dealing with debt

In the Netherlands 1.4 million households have problematic debt. On average it takes five years before someone with problematic debt seeks help. By that time the situation has often got out of hand and they are living in a state of chronic stress and social isolation. Since 2018, Queen Máxima has been committed to eliminating debt problems in the Netherlands. From 2022, she has done so in her capacity as honorary chair of Stichting SchuldenlabNL, an organisation which strives to ensure that financial problems are identified and addressed as early as possible. It aims to prevent people having to start from scratch to find a solution, but instead have methods available that are proven to be successful.

There is a lot that businesses and government organisations can do to prevent problematic debt among employees, customers and the public. Queen Máxima was a driving force behind the establishment of the National Financial Health Coalition in 2022, in which over 40 employers have joined forces.

Full speed ahead

What started in 2005 with efforts to promote microcredit has, 20 years later, developed into wide-ranging activities to foster financial health and development opportunities. Together with many partners in the Netherlands and abroad, Queen Máxima continues to work enthusiastically in this area. Her UN role and her roles in the Netherlands as honorary chair of the Money Wise Platform and Stichting SchuldenlabNL are mutually reinforcing. In addition, she is also a member of the Netherlands Committee for Enterprise, which works to promote growth opportunities for small and medium-sized enterprises.

Underlying her work in all these different roles is her belief that everyone deserves every opportunity to participate and develop. That the financial system must serve the people instead of the other way around. And that financial health is essential for people’s happiness, which makes it worth every effort!